There are things we take for granted in Australia. Things and experiences we assume will always remain available to us, regardless of how much we might personally use them.

Free access to the beach, universal health care, and that jar of coins next to your dad’s bed.

But like our beloved Fantales lollies and Arnott’s Classic Assorted biscuits, whose recent (and shocking!) demise was credited to a lack of demand, could Dad’s coins and our colourful notes be the next thing to go? A joint casualty perhaps of our ‘she’ll be right’ complacency and an apparently insatiable desire for more convenience.

With the wave of a device, card, or a few keystrokes, could we be unwittingly sending a message that we no longer need or want our cash?

It seems we are.

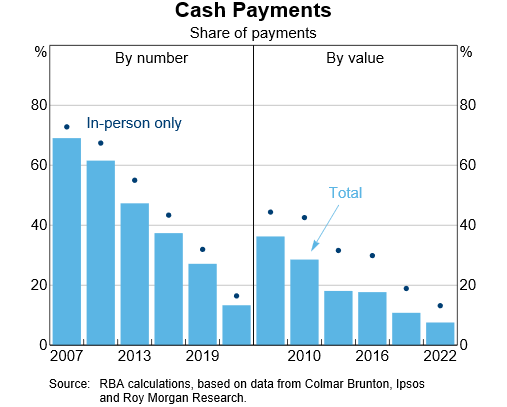

According to the Reserve Bank of Australia’s (RBA) most recent Consumer Payments Survey (CPS), over the three years to 2022, “Australians halved their share of cash payments by number, from 32 per cent to 16 per cent of in-person transactions”.

If one considers all payments, including online payments, “cash payments made up 13 per cent by number and around 8 per cent by value in 2022”.

The RBA’s June 2023 bulletin reports a decline in cash use between 2019 and 2022 which they note “partly reflects the impact of the COVID-19 pandemic on people’s payment behaviour, which accelerated the decline that had been underway since at least the first CPS in 2007”.

Similarly, the Online Banknotes Survey (OBS), which asks individuals about their cash use behaviour, shows that in 2022, “cash was used by 25 per cent of respondents in their most recent in-person transaction, which is similar to the previous two years”.

Vulnerable Australians at greatest risk

Should we be worried about that?

Kim, from Canberra, is.

Kim, 35, is on a low income due to health challenges and has been asking people for cash help for some years outside Canberra shopping centres. “People comment now that they don’t carry cash anymore and that means that sometimes I don’t eat. I don’t like to ask for much, but over an hour people used to be able to give me about 50 or 60 dollars, now it takes about three hours to receive the same amount,” he says.

And Kim is not alone; 123,000 Australians to date have signed a petition asking for a cash and banking guarantee in Australia.

Peter Gordon, CEO of Hands Across Canberra says that this is not surprising.

“Changes that create difficulties impact the vulnerable the most. When times are tough, the people who have no resources do it incredibly tough,” Mr Gordon says.

Certified Practising Accountants Australia (CPA) spokesperson, Elinor Kasapidis, Head of Policy and Advocacy, agrees.

“The pressure to adopt digital financial services is likely to be felt the hardest in regional and remote areas, as well as among disadvantaged groups and the elderly,” Ms Kasapidis says.

“In emergencies, like natural disasters or fleeing domestic violence, cash can be critical to enable people and businesses to pay for goods and services. For some people, the ability to use cash provides a level of security and protection they may otherwise not have.”

Canberra GP Dr Anita Hutchison, of the advocacy group Doctors Against Violence Toward Women, and herself a domestic violence survivor says, “Cash can’t be traced and so may be used to access a lawyer and psychologist or to develop a plan to escape or stay in alternate accommodation. Whereas the use of electronic payments makes it easier for perpetrators to stalk, therefore increasing the risk of someone being harmed or located.”

What about Australian businesses?

An article published by the RBA in March of this year suggests that “half of merchants that accepted cash in April 2022 planned on actively discouraging cash payments or displaying signage to that effect at some point in the future”.

The merchants who plan to move away from accepting cash however “were more likely to have higher turnover and be in metropolitan areas”. Again, indicating that those with the most to lose in a move to a cashless society are smaller local businesses who are the most vulnerable.

Georgina Kounnas, owner of The Allergy Centre Jamison in the ACT agrees.

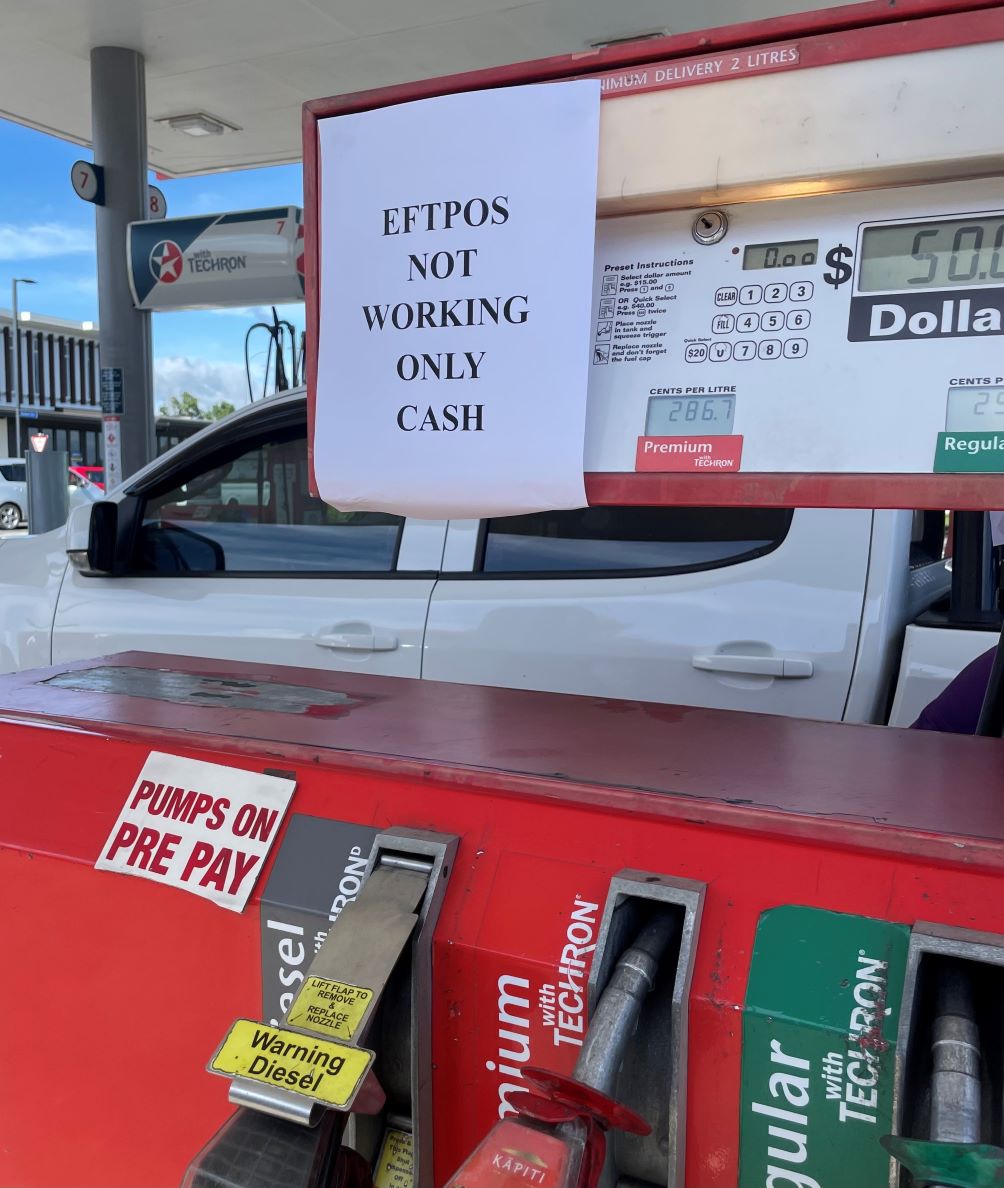

“Cash is indispensable for small business as it reduces the costs related to electronic transactions and provides a sense of security if there are technological disruptions or system failures. Our business is charged on average $2,000 a month in costs and fees related to electronic transactions,” Ms Kounnas says.

CPA’s Kasapidis confirms that “a one or two per cent charge for paying by card may not seem a lot in isolation, but for people struggling to make ends meet, it can make a difference”.

Protecting use of cash

Last week, the UK parliament passed a new law which protects the use of cash and ensures that they must provide fee-free local access to cash withdrawals for almost every person and business in the UK.

The UK joins a growing number of jurisdictions protecting the role of cash, including Austria, Spain, New York, New Jersey, Philadelphia and San Francisco. There are draft laws now before congress in the USA to protect citizen’s rights to use cash.

So, what is Australia doing to protect the interests of Kim, Georgina and Anita?

“Australia must follow other countries and move to protect our right to access and use cash,” says Jason Bryce, spokesperson for the Cash Welcome campaign.

“Physical cash is publicly-owned essential national economic infrastructure. Going cashless represents a privatisation of our money system and means we have to pay to use our own money,” says Mr Bryce.

However whilst the senate’s Rural and Regional Affairs Committee is currently investigating the issue of ongoing bank closures, Treasurer Jim Chalmers has begun a process of modernising Australia’s payment system.

And the RBA?

Professor Gigi Foster from the University of NSW School of Economics reports that when she visited the RBA’s Kirribilli address last month, she asked a question about whether the general public should fear that Central Bank Digital Currencies and other digital currencies will be allowed to replace cash.

“I was told verbatim that the RBA is committed to making cash available for as long as people demand it,” she says.

A sentiment confirmed in print where the RBA, as part of its 2022/23 Corporate Plan states, “We’ve chosen a balanced approach that will best support the industry so as to ensure cash continues to be available to those who want to use it”.

But is it solely up to the RBA and our government to ‘keep cash alive’?

Use it or lose it

Professor Foster doesn’t believe so. She believes that ‘we the people’ need to demand it.

“We can do that through hoarding it, but we can also do that through using it rather than other means of payment at shops, at school fetes, for donations to the homeless and other charitable causes, to pay our kids or other needy family members weekly or monthly allowances, and to provide short-term loans to friends and family,” she says.

Professor Foster adds, “One thing I make a point of is not giving my business to stores that do not honour cash. Cash issued by sovereign national governments has for a long time been the most successful and universally accessible currency in history: legal tender everywhere in an economy and with everyone able to access it, regardless of their financial credit score, social credit score, assets, type of job, or any other attribute.”

She encourages Australians to “use our voice and our financial decisions to keep cash filling that default role of fairness in our society, even as new currencies come on the scene”.

There is no doubt many Australians are lamenting that they did not continue to buy those Fantales and Arnott’s Classic Assorted biscuits.

However, it appears that the consequences of complacency when it comes to using our cash are far more significant.

Use it or lose it.

Have an opinion?

Email [email protected] with ‘To the editor’ in the subject field; include your full name, phone number, street address (NFP) and suburb. Please keep letters to 250 words maximum. Note, letters may be shortened if space restrictions dictate.