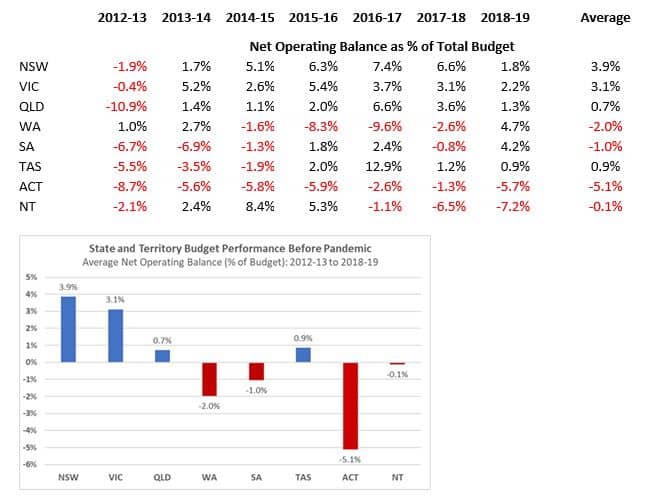

A week after calling for an audit of the ACT’s finances, Canberra Liberals leader Elizabeth Lee claims that data from the Australian Bureau of Statistics highlights the Territory’s budget failings: the ACT was the only jurisdiction in the country that did not record a single surplus in the seven years before the COVID pandemic, she noted.

“Straight from the Coe playbook,” Chief Minister Andrew Barr retorted. (Former Liberal leader Alistair Coe had made similar claims during the 2017-18 Budget Estimates.) “Nothing has changed. Same old Canberra Liberals. Can’t even come up with anything original.”

- 2022–23 Budget invests in ACT’s future, Andrew Barr says (2 August)

- Canberra Liberals call for ‘warts and all’ ACT budget audit (2 August)

The ABS data shows that from 2012-13 to 2018-19, the ACT recorded an average net operating balance of -5.1 per cent, well behind all other states and territories, Ms Lee said.

During the same period, New South Wales, Victoria, and Queensland all recorded a surplus in every year except one.

“While the Chief Minister and his government like to blame COVID for their problems, the fact of the matter remains he has not once delivered a surplus in 11 years as Treasurer,” Ms Lee said.

“The ACT went into COVID as the worst performing state or territory, with all other jurisdictions in the country much better placed to deal with the economic fallout of the pandemic.

“For too long, the Chief Minister has not been upfront with the community about the true state of the Territory’s finances, and this data once again highlights how poorly the ACT has measured up to other states and territories.

“With net debt forecast to be at $6.5 billion this financial year rising to just under $10 billion by 2024-25, Canberrans have every right to ask the Chief Minister where all that money has gone.

“Our health system is in crisis, our education system is failing, we have the lowest number of police per capita, we have fewer public housing dwellings than ten years ago, and our basic city services are not befitting of the nation’s capital.

“It was astounding last week to hear the Chief Minister clearly state that his government is meeting demand. With so many areas failing across the territory, it is clear he is either not being upfront with Canberrans or is deluded,” Ms Lee concluded.

ACT Government response

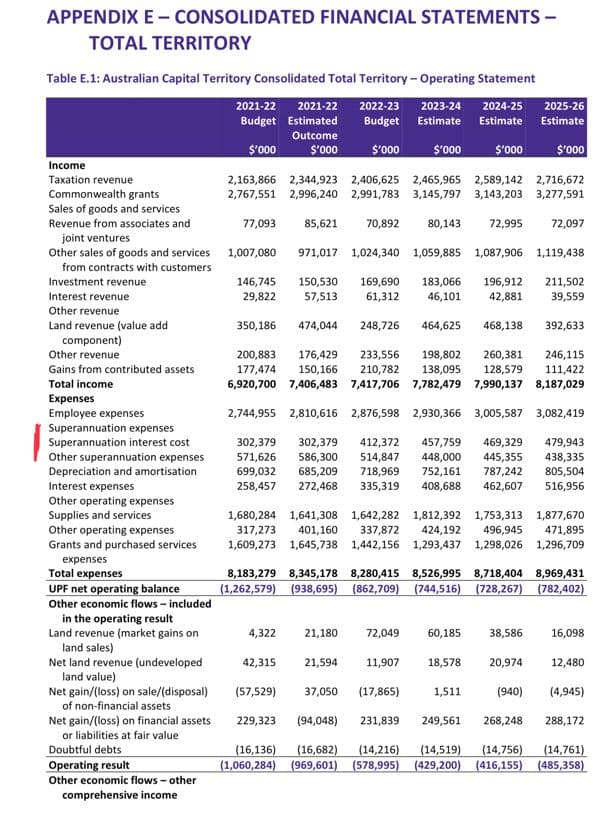

The government maintains a funding plan to extinguish the Territory’s unfunded defined benefit superannuation liability over time. The funding plan involves the accumulation of funds in the Superannuation Provision Account. Budget appropriation is applied to annual benefit payments, with investment earnings re-invested to increase the pool of investment assets to reduce the longer-term cost of this obligation.

In the ACT, the Superannuation Provision Account sits in the General Government Sector, and hence is included in its UPF expenses.

The ACT Government’s superannuation arrangements are unique in that they do not operate a dedicated superannuation scheme for our employees.

Since October 2006, ACT Government employees have been able to make their own choice of superannuation fund; the Commonwealth Public Sector Superannuation Accumulation Plan was the default scheme from July 2005 until October 2006. Before then, ACT Government employees participated in the Commonwealth Government’s defined benefit employee superannuation schemes, including the Public Sector Superannuation Scheme and the Commonwealth Superannuation Scheme. As a result, some past and current ACT employees continue to be members of the Commonwealth defined benefit superannuation schemes.

The Government recognises a defined benefit superannuation liability on behalf of those employees, and is setting aside funds in the Superannuation Provision Account to assist in meeting those liabilities in the long term.

As a result, the accounting treatment for the defined benefit superannuation liabilities differs from that in other States and Territories.

Under the Uniform Presentation Framework (UPF), the superannuation expense associated with the defined benefit superannuation liability is reflected in the Net Operating Balance. However, any investment earnings from funds set aside in the Superannuation Provision Account that are classified as capital gains are excluded from revenue. To ensure that the defined benefit superannuation expenses and revenue are reported on a consistent basis, a Superannuation Return Adjustment is included to produce the Headline Net Operating Balance (HNOB). The superannuation return adjustment, when combined with income earnings recognised in transaction revenue, equates to the total target investment return objective for the financial investment assets set aside in the Superannuation Provision Account (CPI+4.75 per cent). Over the past 26 years to 30 June 2022, the SPA has achieved an investment return of CPI+4.92 per cent per annum.

The Government considers that the HNOB provides the most relevant and meaningful information for making long-term budget allocation decisions, and the inclusion of the full amount of the long-term investment earnings is necessary to provide an accurate assessment of the longer-term sustainability of the budget position. This presentation and HNOB measure has been in place since 2006-07.

“If the Canberra Liberals plan to use the UPF as their budget benchmark, then they will have to significantly slash public expenditure or no longer fund the superannuation entitlements of ACT Public Sector workers to ever reach a budget balance,” Mr Barr’s office said.