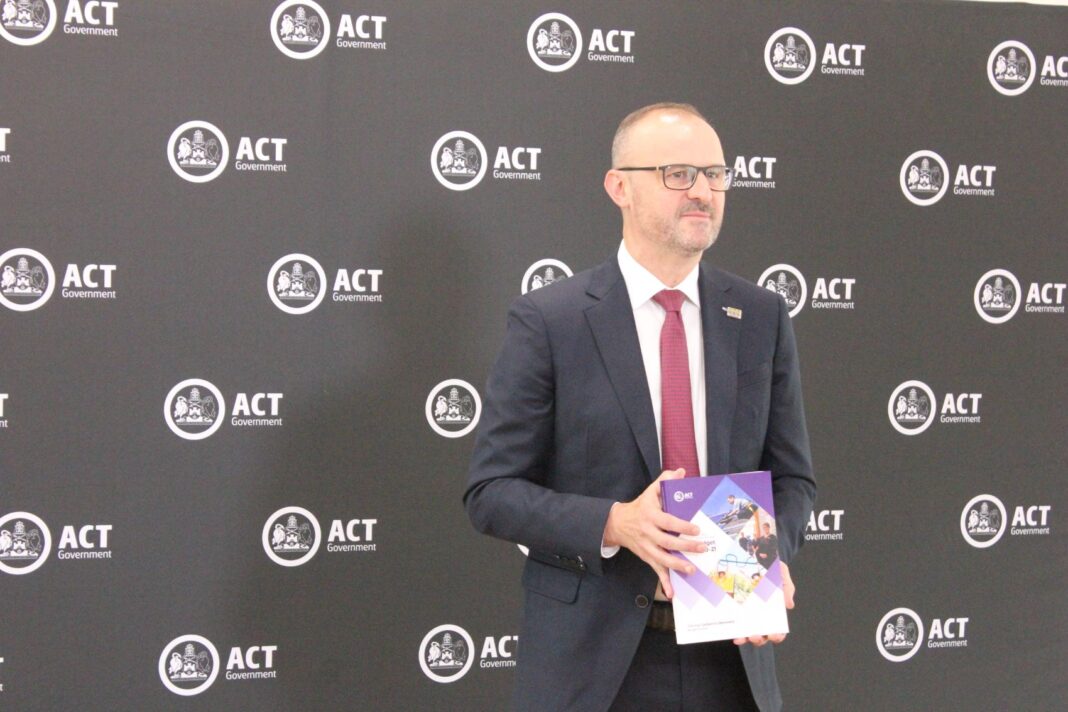

ACT Chief Minister Andrew Barr handed down the 2021-21 Budget yesterday, Tuesday 9 February, which was focused largely on driving Canberra’s recovery following COVID-19.

Health and education, unsurprisingly, made up just over half of this year’s Budget, and while the ACT Greens gave it a glowing review, the Canberra Liberals raised concerns over higher rates and failing services.

Here’s how local groups and peak bodies in the ACT have responded to the 2020-21 ACT Budget.

ACT Council of Social Service

ACTCOSS said yesterday’s Budget fell short on investment for struggling Canberrans.

While the organisation welcomed some measures including the $37 million to improve building sustainability for public and social housing, CEO Emma Campbell said the Budget is “most notable for what is missing”.

Dr Campbell highlighted concerns about the lack of ongoing funding for community sector services and no additional funding to increase social and affordable housing as per the Labor-Greens Parliamentary and Governing Agreement.

“We are deeply concerned that this ACT Budget funds some [community sector] services for only one or two years. This means organisations, their staff and their clients have no future certainty.

“We would like to have seen more investment in community-based early intervention services that prevent people from entering the justice system.”

Dr Campbell also criticised the “little new spending” on vulnerable and disadvantaged groups, including people with disability, older people and carers.

“One ray of hope is the Knowledge Capital – Future Jobs Fund announced in today’s Budget,” Dr Campbell said.

“As a growing sector, and a major creator of jobs and economic growth, we urge the ACT Government to ensure that the needs of the health and community sector are included in the Future Jobs Fund program.”

Canberra Business Chamber

CEO of the Canberra Business Chamber, Graham Catt, “cautiously” welcomed the Budget, but said businesses would still need support in the recovery from the COVID-19 crisis.

“Now we’re in a recovery phase we need a focus on initiatives that support and foster the local businesses that provide more than 60% of Canberra’s jobs.

“That support, particularly as JobKeeper and other support is wound back, is the best way to protect and create jobs,” he said.

He called for small businesses to be included in the introduction of zero-interest loans for private households to install solar and buy zero-emission vehicles, and said the Better Regulation Taskforce must deliver genuinely business-friendly policies.

The Chamber also welcomed the announcement of funding for the Big Canberra Battery and the Woden light rail project but wants to ensure the money would be spent with local business.

“As we move into a recovery phase, it is also important for business confidence that we see a detailed strategy to return the Budget to balance and start repaying debt.

The Chamber also says long-term thinking is needed about changes in key areas like skills, taxation and planning that will support economic growth and jobs creation.

Master Builders

Master Builders welcomed yesterdays Budget for its focus on the creation of jobs and “leading the Territory into recovery”.

ACT CEO Michael Hopkins said Budget measures including those to fund infrastructure and capital works projects would continue to provide short-term support for the local building and construction industry.

“Over the longer term, forecasts about slowing population growth paint a concerning picture for the ACT economy,” Mr Hopkins said.

“Once the short-term benefits of economic stimulus wear-off, economic reform will be needed to drive growth in the local economy.”

He highlighted the importance of private sector investment, saying without reform in the area of skills and training, planning and continued taxation reform, the ACT would lose this investment to other parts of Australia.

“We encourage the ACT Government to continue to work closely with the local industry to ensure policies are implemented which create jobs, drive economic growth and support Canberrans into careers in the construction industry.”

Property Council of Australia ACT

Property Council of Australia’s ACT executive director, Adina Cirson welcomed the “extension of many of the targeted stimulus measures, which the Government says have helped sustain the private sector through the pandemic” and urged the ACT Government to “keep a watching brief on market conditions post June 2021 and not rule out further extending stimulus measures”.

“The Government has noted that there is still a lot of uncertainty in the economy so winding back stimulus measures that have been effective in keeping our economy relatively stable – like winding back of stamp duty concessions, reducing lease variation charge remissions and lifting the hold on rates increases – quite simply might be jumping the gun,” Ms Cirson said.

The Budget papers also noted that a prolonged period of heightened uncertainty and low demand could dampen scope for investment to recover due to delaying capital replacement, or general unwillingness to undertake the risks associated with beginning a major project or business venture.

“As such, a targeted strategy aimed at both population and growth continue to be the most critical areas that need focus beyond the end of this financial year, and that means making sure Canberra remains a competitive and attractive place to live, study, work, invest and do business in,” Ms Cirson said.

“In order to do that we must make sure that our tax settings are fair and sustainable, that we innovate to attract investment here and that the infrastructure investment pie – as delivered in this Budget – continues to grow. It is why we also welcome the Jobs for Canberrans and the Fast-track Infrastructure Program and acknowledge the Government’s quick action last year to provide payroll tax waivers and deferrals, waivers of licence fees, residential and commercial rates rebates, and utilities bill rebates.

“The broad message we want the ACT Government to consider from industry is that we are not out of the woods yet and they must remain agile to the conditions and respond with stimulus if required,” Ms Cirson said.

For more on the ACT Budget: