Retail sales volumes have fallen for the first time since the September quarter 2021, as consumers reduce their spending.

The Australian Bureau of Statistics reported on Monday retail sales volumes fell 0.2 per cent in the December quarter, which followed a 0.3 per cent rise in the September quarter.

“Retail sales volumes fell for the first time since the September quarter 2021, with volumes falling across all non-food industries as consumers tightened discretionary spending in response to mounting cost of living pressures,” ABS retail statistics head Ben Dorber said.

Retail prices remain high, but price growth slowed to 1.1 per cent in December because of flat food retailing prices and additional discounting during Black Friday sales.

Department stores had the largest volume fall (-2.9 per cent), followed by other retailing (-2.4 per cent), clothing, footwear and personal accessory retailing (-2.3 per cent) and household goods retailing (-2.0 per cent).

Retail trade volumes fell consistently across the country, with five of the eight states and territories recording a fall.

The figures came ahead of a Reserve Bank board meeting where it is widely expected to raise the official cash rate from 3.1 per cent, in a bid to contain inflation.

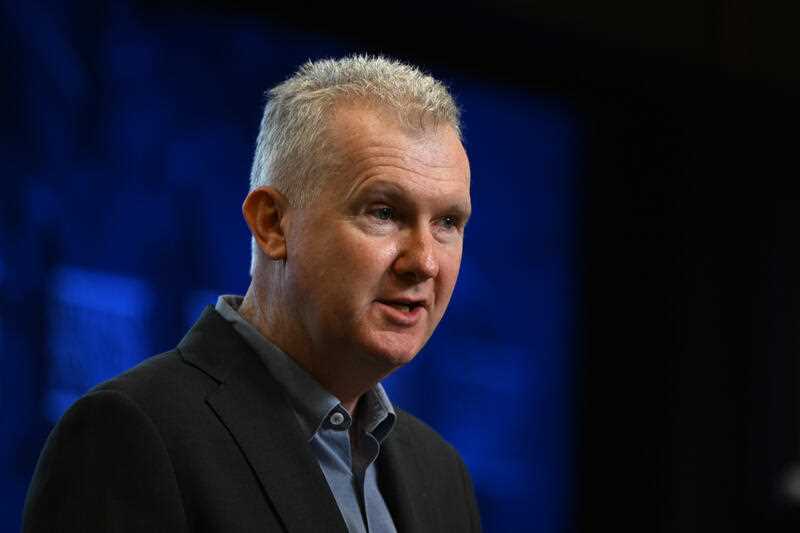

Workplace Relations Minister Tony Burke said while inflation was putting pressure on hip pockets following recent increases, wages were gradually starting to move.

“(Wages are) at 3.1 per cent, which is still perilously low compared to what’s happening with inflation, but the legislation we put through last year means that will continue to move up,” he told ABC Radio on Monday.

“Wages will be starting to go up now, some prices will be coming down.”

However, shadow treasurer Angus Taylor said the likely interest rate rise would mean more financial pain for mortgage holders.

“2023 is going to be a tough year for hardworking Australian families,” he told reporters in Canberra.

“They’re seeing increases in their energy bills. They’re seeing increases in their mortgage payments, increases in their rents, increases across the board with rising inflation.

“Double-income families are struggling to make ends meet, having to put in extra hours at work at exactly the time they’re supposed to be picking up the kids. This is tough.”

Financial comparison site Canstar estimates home loan repayments for the average $500,000 loan will cost close to $12,000 more a year from Tuesday.

If, as predicted, there is a 25 basis point rate rise, it will increase mortgage repayments since April 2022 on a $500,000 loan over 30 years by $969 per month or $11,628 per year.

Canstar’s Steve Mickenbecker said this was the equivalent of the average annual costs for home and contents, car and health insurance, electricity, gas, internet and mobile phones combined.

However, refinancing into a lower rate loan could cut the impost by almost half, Canstar estimated.

Environment Minister Tanya Plibersek said recent interest rates hikes had been putting pressure on families.

By Andrew Brown and Paul Osborne in Canberra