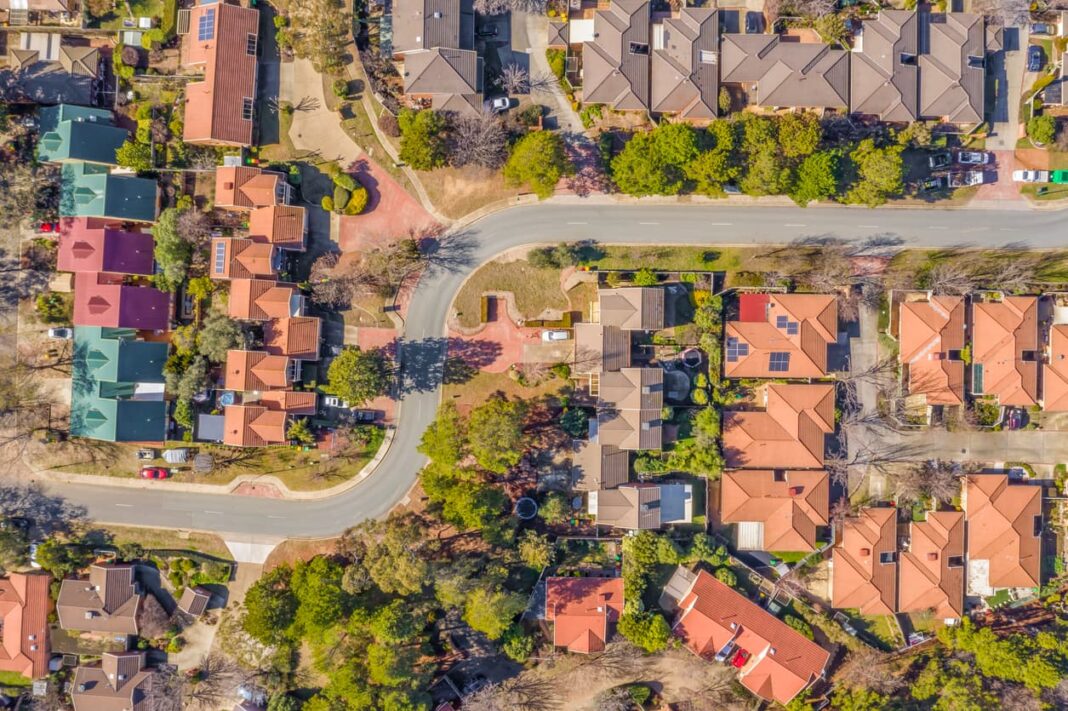

Will Canberra’s median house price hit $1 million?

A median house price exceeding $1,000,000 in Canberra appears to be a forgone conclusion, with the only debatable point being the timing of when.

CoreLogic has reported Canberra’s auction clearance rate was 86.3%, which was the second highest nationally, achieving a median sale price of $938,650 for houses. During growth cycles, the median sale price at auction is persistently higher than the reported median dwelling prices as auction results are a live indicator of how buyers and vendors perceive market conditions. With clearance rates consistently above 80%, often above 90%, and suburb record sale prices tumbling across Canberra, it’s only a matter of time before Canberra’s median house price exceeds $1,000,000.

Stamp duty concessions to buoy off-plan market

The Federal Government’s recently concluded HomeBuilder scheme has undoubtedly increased off-plan sales volume across Canberra. During the last couple of weeks approaching the conclusion of the scheme, clients and colleagues have asked if I expect sales volume to fall significantly. From today (1 April), I anticipate the $0 stamp duty payable on purchases up to $500,000 or stamp duty discounted by $11,400 on purchases up to $750,000 for owner occupiers in the ACT until 30 June will continue to drive transaction volume.

Across the portfolio of off-plan projects I work on, investor enquiry has increased significantly during the past six months. Interstate investors perceive property prices and rental yields in Canberra as value compared to other capital cities. The ability to exchange contracts on a 5% cash deposit and lock in exposure to an upward market cycle of increasing apartment and townhouse values and rents is quite attractive; especially when hedged on the basis that if neither increases, investors can access historically low interest rates to settle and Canberra’s rental market is described by the media as in a state of crisis due to lack of available stock.

In the off-plan market, those who invest in quality stock early in the release program and can be patient to wait for delivery, are generating robust returns. During the first quarter of 2021, there were many instances where those who bought in late December had comparable or inferior properties to what they exchanged on sell for over 5% more than their contract price.

Developers, however, face the dilemma of accelerating their pipeline to market now and take advantage of current conditions or hold out for potentially higher prices and risk Australian Prudential Regulation Authority (APRA) introducing macroprudential controls, which may temper buyer demand and soften market conditions. At this stage, APRA have made it clear they do not see any indication of deteriorating lending standards that would warrant their intervention. With this in mind, conditions between April and September appear favourable to launch new projects.

Editor’s note: Sam Dodimead is the listing agent for a number of developments where off-plan purchases can be made.

With Sam Dodimead, local property professional and host of Canberra Property Podcast where you can get to know the consultants contributing toward delivery of new buildings. Stream from wherever you listen to podcasts.

Read the last market wrap here.

Find property listings at Canberra Daily Real Estate.